- BTC is 14.4% down over the past month.

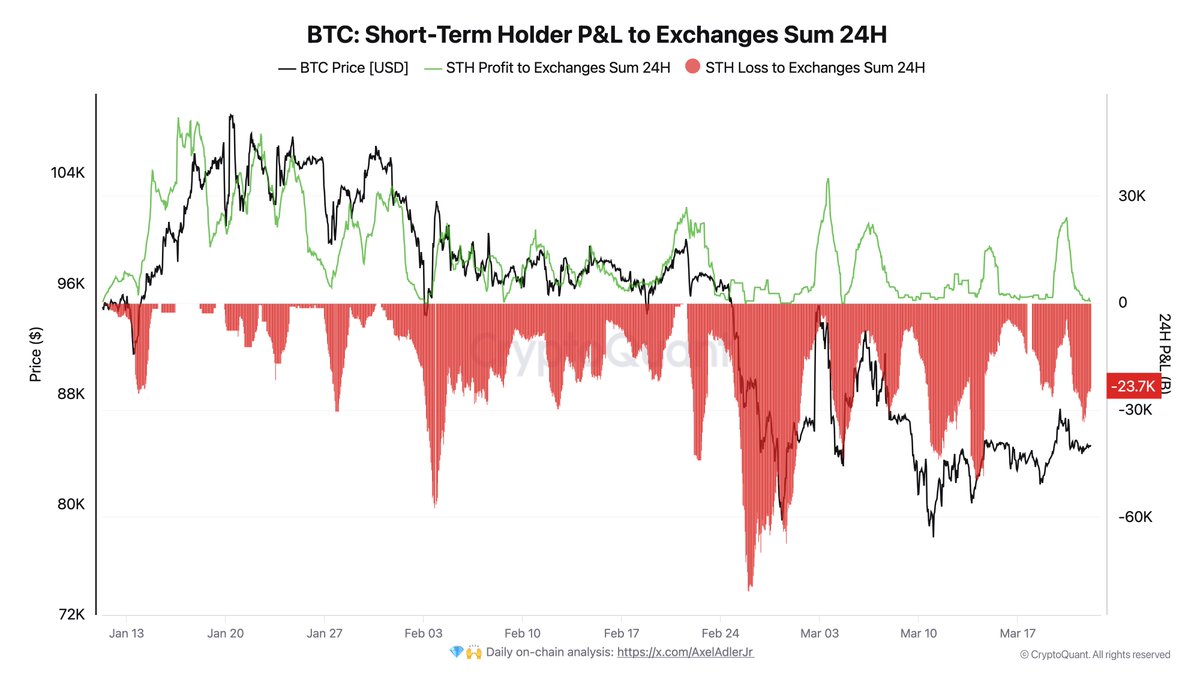

- Bitcoin’s long-term holders refuse to sell, but short-term holders feel different as losses rise.

Since hitting $109k, Bitcoin [BTC] has struggled to maintain an upward momentum. Over this period, volatility has surged, as BTC prices continue to fluctuate.

Despite this heightened fluctuation, Bitcoin’s long-term holders refuse to close their positions, as per CryptoQuant.

Bitcoin’s long-term holders remain steadfast and their coins are not moving. Looking at the Inactive Supply Shift Index (ISSI), it suggests that there’s no significant selling pressure from long-term holders.

Thus, there’s a structural demand outpacing supply. Smart money isn’t exiting, but strategically positioning for the next Bitcoin’s trajectory.

Historically, when LTHs hold their trade, it reflects strong conviction which often precedes major price expansions. Conversely, when they begin to distribute, it typically aligns with market tops.

Therefore, if the LTHs are not selling, it suggests market confidence among this cohort. However, although LTHs are optimistic, short-term holders are not.

As such, the STH realized price is set around $92K, putting this cohort at a loss since the 6th of March.

Periods of uncertainty are usually difficult for weaker hands, often forcing them to capitulate. This suggests that there’s different market behavior from LTHs and STHs.

What BTC charts suggest

Based on the analysis provided by CryptoQuant, there’s no significant selling pressure from long-term holders.

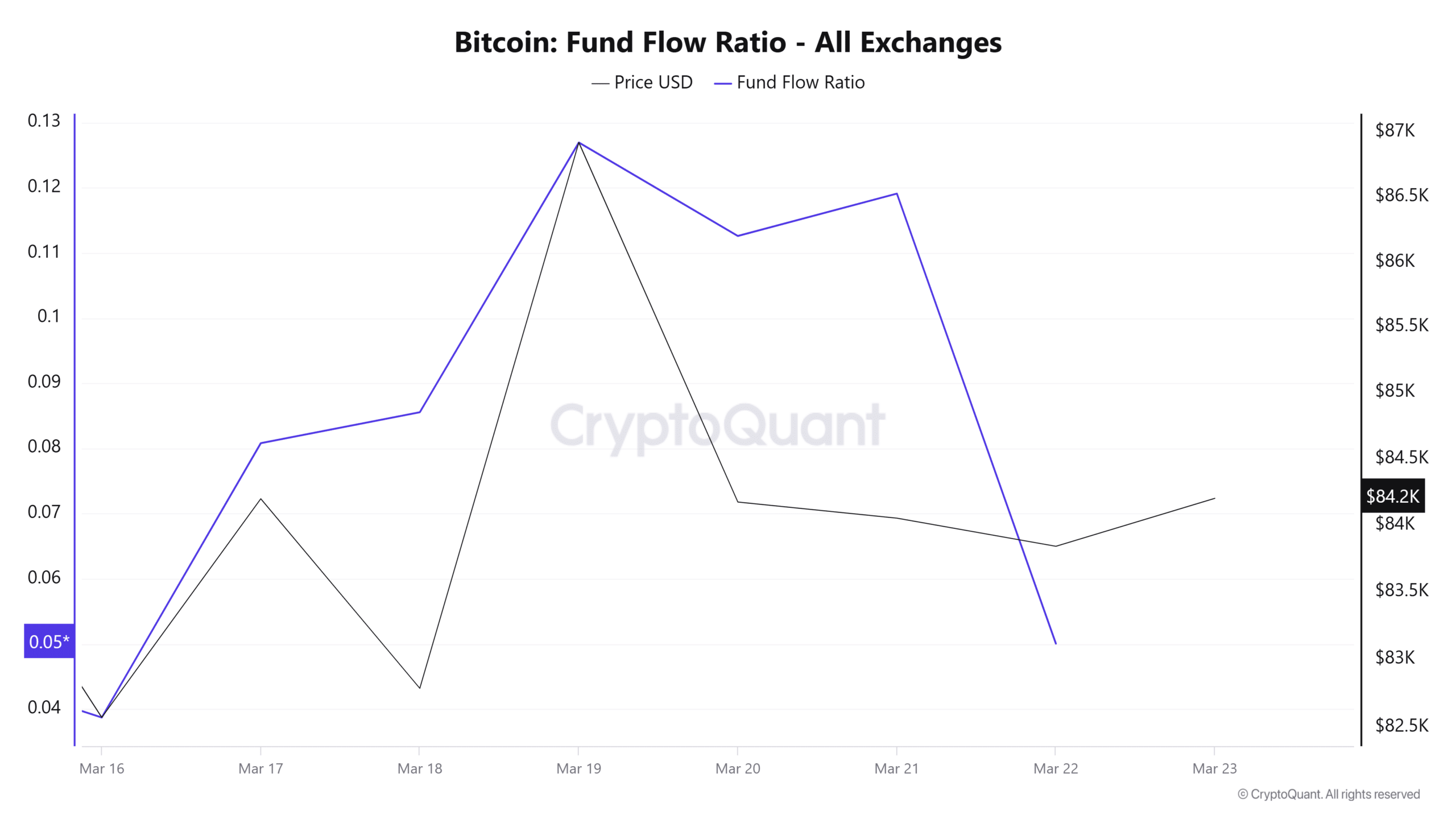

According to AMBCrypto’s analysis, activities on the sell side have drastically declined. We can see this shift as Bitcoin’s Fund Flow Ratio has declined from 0.12 to 0.05.

This drop suggests that fewer funds are flowing into exchanges, thus there is less immediate sell pressure from holders. As such, LTHs might be accumulating or holding, which reduces the likelihood of a large sell-off.

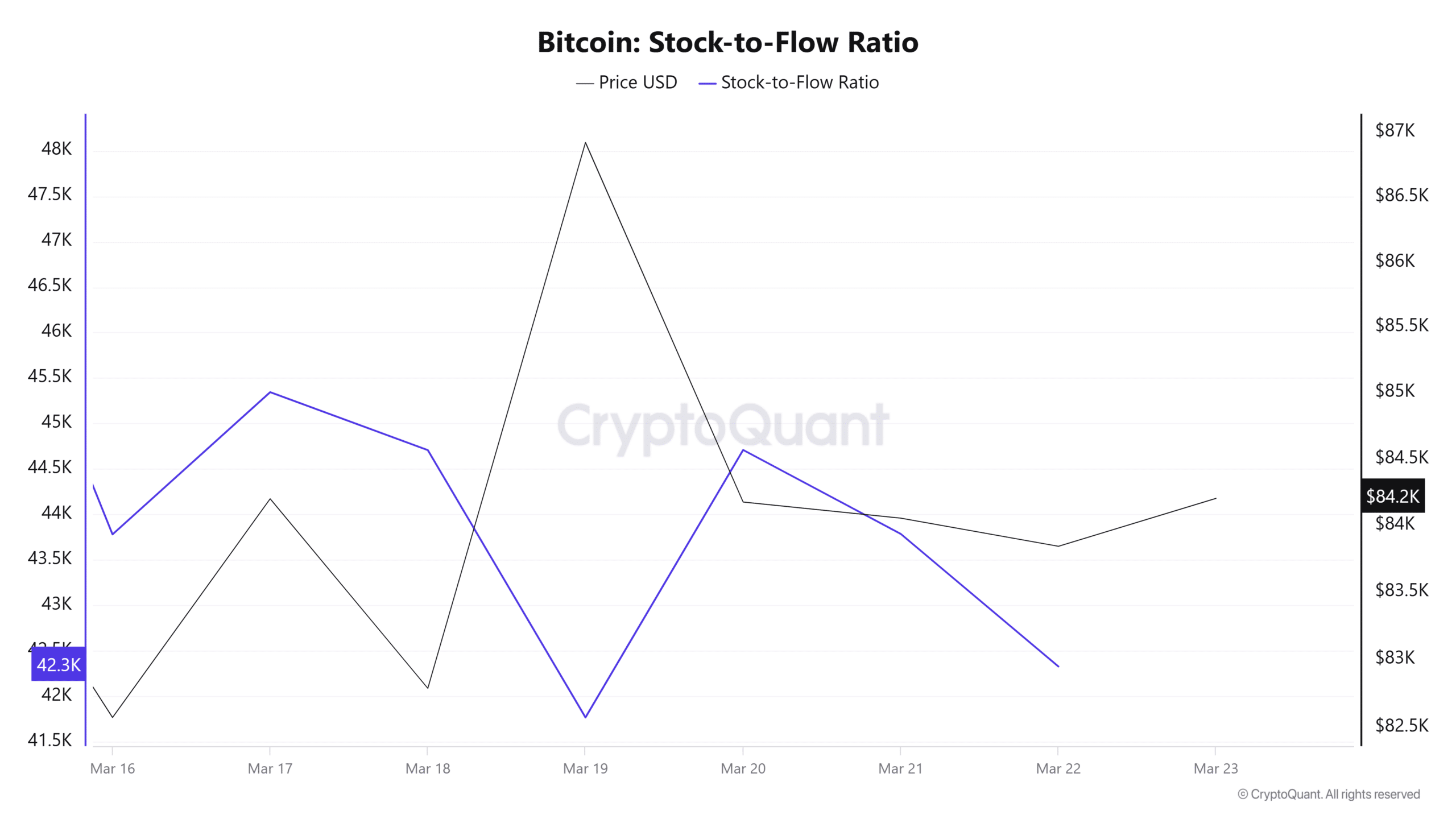

This reduced selling pressure is further evidenced by the declining stock-to-flow ratio. Bitcoin’s SFR has dropped from 43k to 42k over the past week.

When supply declines while demand remains constant or rises, prices are likely to rise.

Therefore, the current market conditions show that although there’s selling activity, the demand side is gradually absorbing it.

With LTHs refusing to sell while STH is capitulating, it suggests a continued consolidation.

If sellers and buyers continue to battle, we could see Bitcoin continue to trade between $82k and $87k. However, a breakout above this range could push the king crypto towards $92k, which is STH’s realized price.