- Short-term BTC holders were facing losses, and BTC has fallen below its 200-day Moving Average.

- Long-term investors need to bide their time, a bullish trend reversal was not yet in sight.

The “Liberation Day” that U.S. President Donald Trump has discussed is approaching. Heading into the week, U.S. tech stocks saw losses in the overnight trading, with Tesla [TSLA] and Nvidia [NVDA] posting 5% and 3% losses, respectively.

The Kobeissi Letter noted that the economic policy uncertainty reached the highest it has since 2020, with the 2nd of April being the date to watch.

Moreover, the U.S. jobs report will arrive on the 4th of April, which could also influence market sentiment outside of the tariff news.

Gold ETFs saw massive capital inflows, likely a direct consequence of the growing economic uncertainty. This has also put Bitcoin [BTC] and the rest of the crypto sphere on the back foot, as they are risk-on assets.

AMBCrypto delved into on-chain metrics to understand if BTC can stabilize around the March lows at $78k or if investors should expect more losses.

Bitcoin nears overbought territory, but…

Source: Checkonchain

The short-term holder MVRV Bollinger Bands chart showed that the oscillator was in oversold conditions in late February and early March.

Also, the price of Bitcoin was below the cost-basis of short-term holders. This is calculated using the realized price of coins moved within the last 155 days.

The price of BTC had been “heated up” in November and December but has cooled off significantly since then. Bitcoin was likely to move below the oversold level, which stood at $78.95k at press time.

Source: Checkonchain

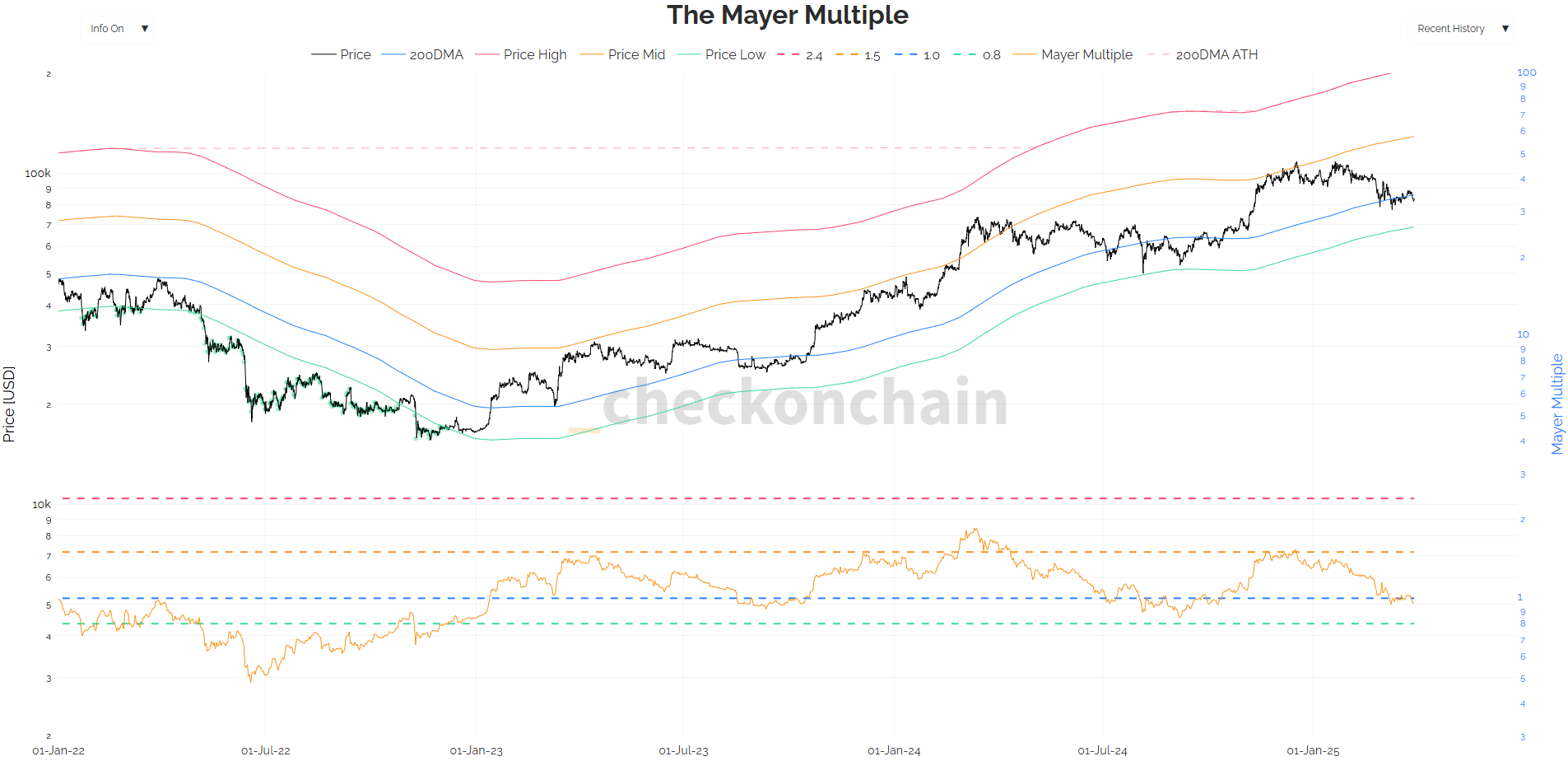

The Mayer multiple serves as a key metric for determining whether Bitcoin is fairly priced, overvalued, or undervalued based on historical trends.

Analysts calculate it by dividing Bitcoin’s market price by its 200-day Moving Average (MA). At press time, the Mayer multiple stood at 0.96.

Two weeks ago, BTC fell below its 200DMA and has traded just below this level for most of this time. It stood at $85.92k at press time.

The last time the price fell below the 200 DMA was August 2024. The price stayed below this MA for almost two months back then.

A similar scenario could unfold now. Investors looking to buy BTC cheap should keep an eye on the 0.8 Mayer multiple, which represented the $68.74k level. Bitcoin would be considered “cheap” around this price level.

In conclusion, long-term investors need to hunker down and weather the economic storm of the coming weeks and months. Once the sentiment across the market begins to shift, the trend might shift bullishly.

Until then, they can Dollar Cost Average (DCA) into BTC or wait for nasty price drops from giant liquidation events to grab more BTC.