- DOGE’s price remains above its long-term ascending channel support, signaling technical strength.

- Whale wallets continue to accumulate, hinting at confidence in a future rally.

Dogecoin [DOGE] is showing signs of resilience as it continues to hold above a key long-term ascending channel, fueling speculation that the memecoin may be on the verge of a potential breakout.

With whale demand showing strength and technical support aligning with historical price structure, the stage may be setting for a rally toward higher levels.

Dogecoin tests lower boundary of ascending channel

On the macro [1W] chart, Dogecoin remains well-supported above the lower boundary of its long-term ascending channel.

This trendline has served as a foundational level since 2015, and DOGE has respected this structure throughout previous cycles.

Source: X

The recent pullback brought DOGE to $0.17, just above the 0.786 Fibonacci level $0.18395, a key retracement area that often precedes a rebound if demand accelerates.

If history repeats, this could mark the beginning of a move back toward the mid-range of the channel at around $0.56 or even higher toward $2.73, the 1.272 Fib extension, assuming broader market momentum returns.

Trends hint at growing confidence

On-chain data supports this technical structure. The Accumulation/Distribution Line was 20.28 billion DOGE at press time, signaling that long-term holders are continuing to accumulate even as price consolidates.

This divergence between price and accumulation often precedes rallies, when buyers are absorbing supply during dips.

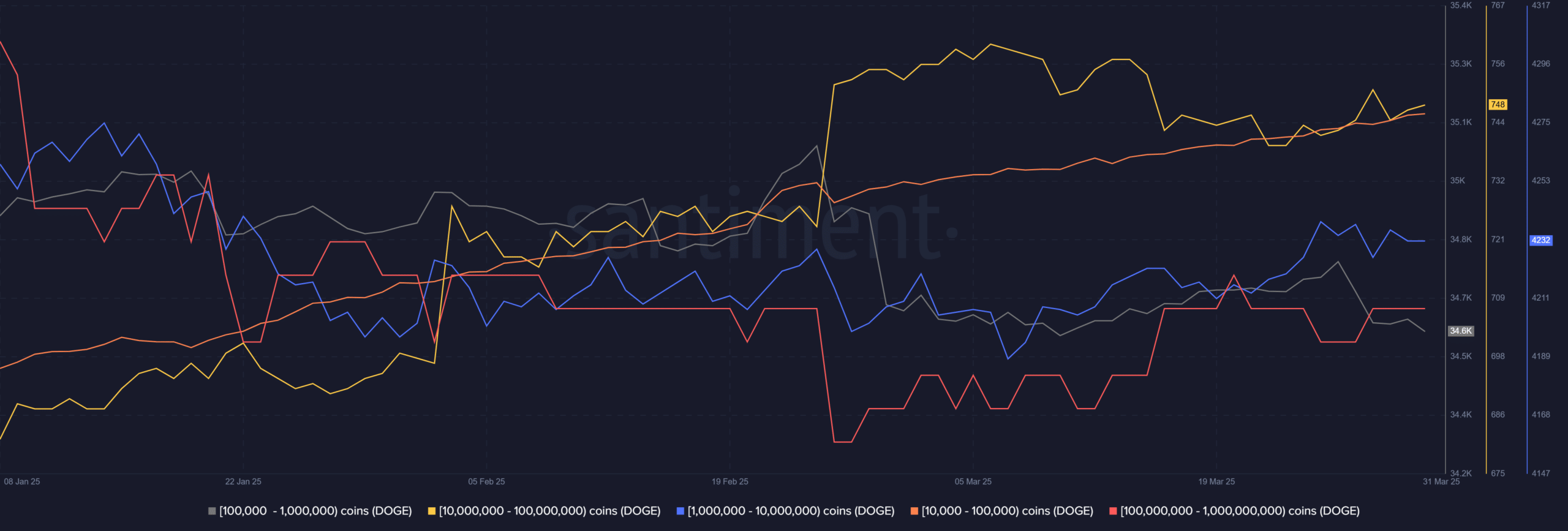

Additionally, Santiment’s cohort distribution data highlights continued demand from large wallets.

Addresses holding [10M–100M DOGE] and [100M–1B DOGE] have seen steady accumulation throughout March, even as mid-sized holders [1M–10M DOGE] slightly declined.

This suggests larger players are positioning for potential upside, possibly expecting a broader market recovery to lift memecoins like Dogecoin.

Dogecoin still under pressure

Despite promising long-term signs, DOGE remains below both the 50 and 200-period moving averages on the 12-hour chart, with the 50 SMA acting as resistance at $0.176.

Momentum remains bearish in the near term, but a reclaim of $0.18 could be the first sign of reversal strength, especially if supported by increasing volume and A/D continuation.

Conclusion

Dogecoin is at a key inflection point. With price holding firm above its decade-long ascending channel and large wallets quietly accumulating, the risk-to-reward ratio may favor bulls.

However, confirmation will only come with a sustained breakout above $0.18. Should momentum build, mid-range targets of $0.27 to $0.56 come into play.