- DOGE whales increased their total holdings from 10.28 billion to 10.51 billion over the last 7 days

- Memecoin’s price dropped by 24% from $0.220 on 3 March to $0.168 on 21 March

Dogecoin [DOGE] has always been a high-volatility asset, but recent whale activity may be a sign of growing confidence in its long-term potential. Over the past week, large investors have accumulated over 120 million DOGE, despite a significant price decline.

This behavior raises critical questions about its market implications. Could these whales be positioning themselves for a price recovery?

Well, research indicated that whales holding 1,000,000 – 10,000,000 DOGE increased their total holdings from 10.38 billion to 10.45 billion over the last 7 days. A strategic accumulation took place during the price downturn, one which caused DOGE’s position to grow by 120 million.

Traditionally, markets see upward swings when whales start purchasing during bearish periods because such accumulation shows their faith in market recovery.

Right now, they are maintaining a long-term outlook as their consistent acquisitions may allow them to benefit from planned future market movement. The ongoing development of retail sentiment by this trend might promote additional market participation, which could lead to higher prices.

Furthermore, DOGE’s price dropped by 24% from $0.220 on 3 March to $0.168 by 21 March. Despite this decline, whales continued to accumulate, signaling a belief in undervaluation.

Such moves often mitigate sell-offs by absorbing liquidity, preventing deeper declines. If retail investors interpret whale accumulation as a sign of a potential price floor, DOGE could stabilize and eventually rebound on the charts.

Breaking key resistance levels at $0.182 or $0.191 might further reinforce bullish sentiment, setting the stage for a potential rally.

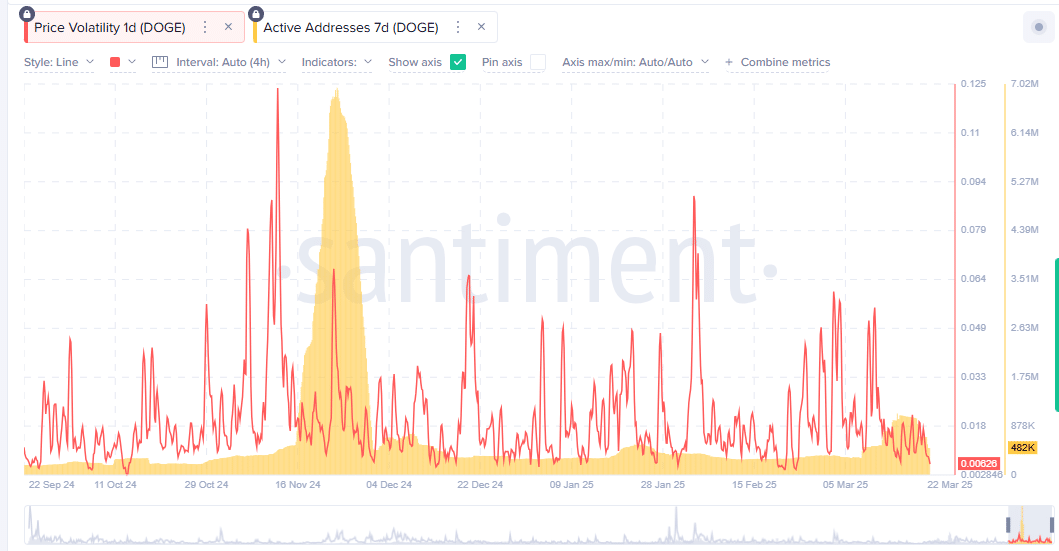

Dogecoin’s volatility amid whale activity

DOGE’s one-day price volatility peaked at 0.125 in November 2024. However, it has since stabilized, with a figure of 0.008 by 22 March 2025. This hinted at reduced speculative swings, often a precursor to renewed accumulation phases for altcoins.

Here, it’s worth pointing out that active addresses declined from 7.02 million in November 2024 to 482,000 by 22 March 2025 – A sign of diminished retail participation. Whale accumulation could drive renewed engagement though. Especially as large transactions frequently correlate with hike in network activity.

If retail investors follow suit, this could further strengthen DOGE’s price action, reinforcing stability and setting the stage for long-term growth.

To put it simply, the accumulation of 120 million DOGE by whales amid a declining market reflects strategic confidence. Their buying activity could stabilize prices, encourage retail participation, and potentially catalyze a broader recovery.