- Hedera could rally upwards following days of a downtrend as the short-term SMAs signal “buy.”

- HBAR could see a potential price reversal if the buying pressure holds past the Ichimoku cloud resistance.

Hedera [HBAR] has surged 3.63% in trading volume in the past 24 hours as the price oscillated around $0.18 at press time, per CoinMarketCap.

HBAR has been trading in a downtrend since the start of the month, fueled by a strong bearish momentum.

With the price sitting at a key support and demand zone, the market wonders if the bulls could take charge, leading to a bounce back.

HBAR technical setup and demand zone

Looking at the 4-hour chart, Hedera has been consolidating in a downtrend, forming a descending triangle pattern. At the time of writing, HBAR was trading at $0.18396, a key support zone.

The coin has tested the $0.182-$0.185 support zone and bounced off multiple times, preventing further downtrend. This suggests demand rises at this zone as buyers step in, reversing the trend.

According to TheCryptoExpress on X (formerly Twitter), a breakout or breakdown from this pattern will confirm HBAR’s next direction.

Will the bulls step in?

HBAR has failed to sustain a significant price uptrend above this demand zone in the last two weeks, as exhaustion follows the price rebounds.

However, traders anticipate a rally following a breakout or breakdown at this demand zone in its descending triangle structure.

Hedera’s short-term momentum, MACD, and moving averages signal “buy” as trading volume rises, indicating heightened buying pressure.

With the RSI at 40 (lower neutral zone), there is more buying potential, signaling that the bulls are stepping in cautiously.

Open Interest rises — Could this lead to a trend reversal?

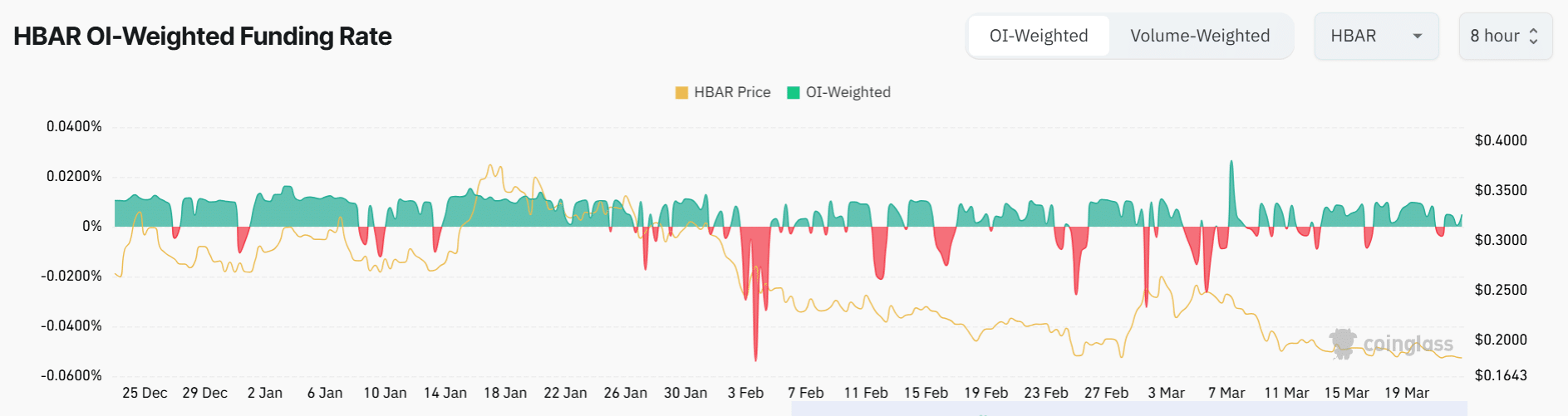

HBAR’s 24-hour Open Interest has surged 4.5% as the Open Interest (OI) Funding Rate turned positive in the past 48 hours till press time, per Coinglass data.

This signaled renewed interest and trader optimism at the key support zone.

At press time, the 24-hour Long/Short Ratio stood at 1.7 and had risen to 1.9 in the lower timeframe, suggesting increased demand, per Coinalyze.

So, what next?

The market seemed to wait for Hedera’s confirmation at the $0.18 key support zone. A trend reversal is possible if the coin breaks above its descending trendline and overcomes the Ichimoku cloud resistance.

With strong buying pressure, HBAR’s chances of maintaining an uptrend in the mid-term could shift from moderate to high. One should watch out for the next move in this pattern formation for further insights.