- XRP remains under $2.50 despite Ripple’s latest SEC court win, facing resistance at key moving averages.

- XRP Ledger addresses hit 6.7M, reflecting long-term interest but no major short-term surge.

Despite Ripple [XRP] recently securing a favorable development in its long-standing battle with the U.S. Securities and Exchange Commission [SEC], the market’s response has been relatively muted.

While the win injected temporary optimism, XRP’s price performance and address activity suggest a more tempered reaction.

XRP moves slow despite legal progress

Following the positive SEC-related news, XRP briefly climbed to $2.43, but has since stabilized around the $2.38 mark.

On the 12-hour chart, the asset remained just above the 50-day Moving Average [at $2.33], yet was still trading below the 200-day Moving Average [$2.52], a sign that a definitive bullish breakout hasn’t occurred.

Trend channel indicators showed XRP attempting to bounce within a narrow ascending range.

If the price fails to reclaim the $2.50 level soon, it may risk slipping back into the descending channel it struggled with throughout March.

Active addresses on the rise, but growth is gradual

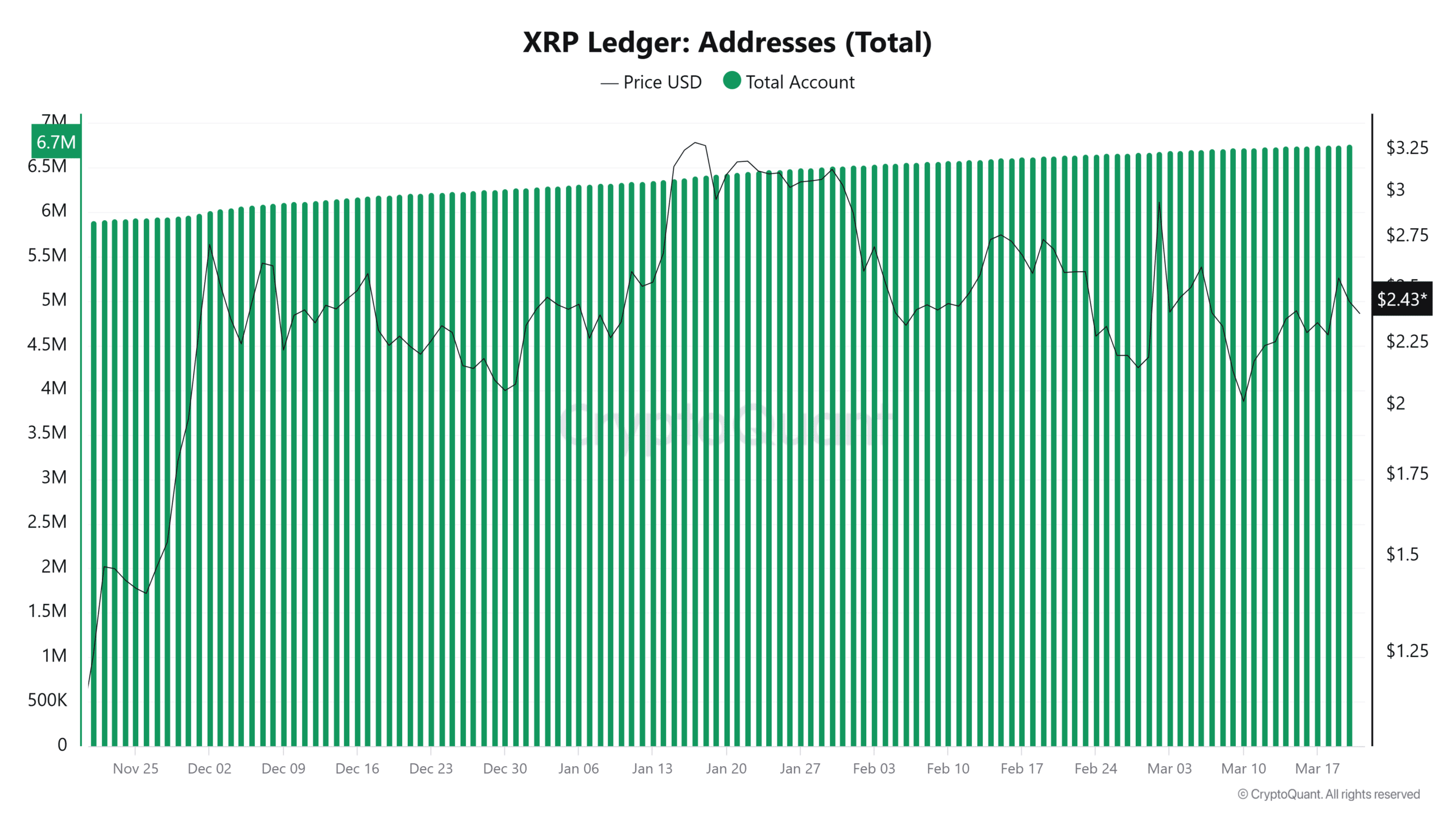

According to CryptoQuant data, the total number of addresses on the XRP Ledger has steadily climbed to 6.7 million.

While this growth is positive, it’s not an explosive surge, hinting that while long-term interest is intact, there isn’t an overwhelming rush of new participants entering the ecosystem following the SEC news.

This restrained on-chain growth reinforces the idea that while regulatory clarity is a long-term tailwind, the market is still digesting the implications.

What this means for XRP, moving forward

For XRP to regain significant momentum, the price must break convincingly above $2.50 and establish support. Otherwise, the sideways movement may persist, especially as broader market sentiment remains cautious.

On-chain metrics suggest XRP holders are adopting a wait-and-see approach. The rising address count provides a solid foundation, but short-term gains may be capped without a surge in active users or volume.

Ultimately, Ripple’s legal clarity is a strong narrative, but translating that into price action and network activity will depend on sustained investor confidence.

Also, it will depend on whether buyers view XRP as a long-term hedge or a short-term play.