- SHIB’s price is down 25.3% in a month, with Open Interest and whale transactions seeing significant declines.

- Technical indicators suggest a possible short-term bounce, but lack of whale accumulation raises concerns.

Alongside the bearishness in the broader crypto market, Shiba Inu’s [SHIB] price has been on a consistent decline in recent weeks.

However, the asset saw an uptick of 0.3% in the past day, rising to $0.00001226 as of press time.

On a larger scale, though, SHIB was still in a downtrend. For instance, over the past week, the memecoin has plunged by 9.4% and even a 25.3% decrease in the past month.

Open Interest decline and its impact on SHIB

While there is no certain reason why SHIB is seeing a steady plunge, a notable factor that can be attributed to its price decline is the consistent decrease in Shiba Inu’s Open Interest.

Open Interest refers to the total number of outstanding derivative contracts, such as futures and options, that have not been settled.

A decreasing Open Interest typically suggests that traders are closing positions, signaling reduced speculation and weakening momentum.

This can indicate a loss of confidence among market participants, which often leads to further price declines if new demand does not enter the market.

According to data from Coinglass, Shiba Inu’s Open Interest has been on a downtrend, and the past day performance of this metric has been no different.

Coinglass shows that over this period, SHIB’s OI has dropped by nearly 10% in the past day to a press time valuation of $105.94 million.

This decline is also seen in SHIB’s Open Interest volume, which has plunged 12.57% over the same period to a valuation of $77.41 million.

Shiba Inu and whale activity

Regardless of this declining Open Interest, analyzing SHIB’s price chart gives further context to where the asset is likely headed, especially in the near term.

Looking at SHIB’s daily time frame, it is seen that its price has recently dropped to the downside to clear out an existing trend line liquidity. Usually, when price clears out liquidity on the chart, a reversal is often expected.

This means with SHIB’s price taking out this trend line liquidity in the downside, a bounce back to the upside could be on the horizon.

To back this up further, it is also seen that SHIB’S price has entered a demand level on the chart, indicating that a rally may be brewing.

However, it is worth noting that this is only a speculative analysis and the bearish trend still lingers. Data from IntoTheBlock shows that SHIB is yet to see any massive accumulation from whales.

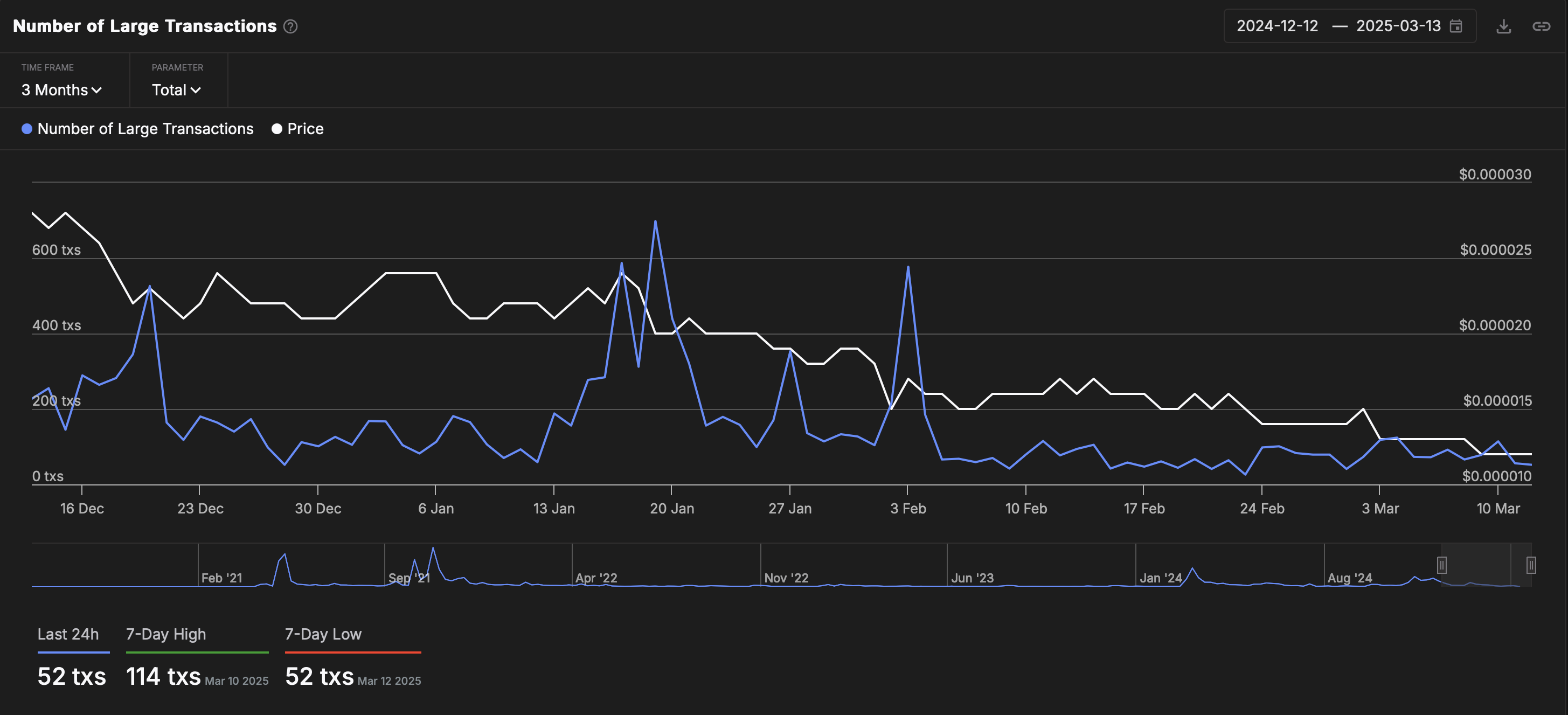

Particularly, Shiba Inu whale transactions have declined from 698 transactions earlier in January to now sitting at just 52 transactions as of press time—marking an over 80% plunge in whale transactions in just the recent months.

This drop in whale activity suggests that large investors are reducing their exposure to SHIB, which could indicate a lack of confidence in near-term price action.

Since whales hold substantial amounts of an asset, their activity often influences market sentiment and liquidity.

If whale accumulation remains low, SHIB may struggle to gain the momentum needed for a sustained recovery.