- SOL network addresses with ≥0.1 balance have surged past 11.1M – Its highest level in months

- Despite rising network activity, Solana’s TVL has dropped from $11.7 billion to $6.2 billion since January

Solana [SOL] has been seeing a significant uptick in network activity lately. Especially as the number of addresses holding at least 0.1 SOL hit a new high on the charts. This metric, which reflects growing user adoption, has been climbing steadily since late December 2024. This, even as the price of SOL corrected from previous highs.

In light of the decoupling of network growth and price action, is the market underpricing Solana’s fundamentals?

Solana’s user adoption soars amid price correction

Data from Glassnode indicated that the number of addresses with 0.1 SOL or more rose from around 9.2 million in late December to over 11 million by 21 March.

This growth in user base can be seen as a sign of sustained interest in the Solana ecosystem, even as the asset’s price slipped from above $180 in January to around $129.54 at press time.

This divergence also suggested that smaller retail participants have continued to accumulate SOL, possibly in anticipation of longer-term gains.

Solana’s TVL faces pressure, but holds key levels

On the contrary, Total Value Locked [TVL] on Solana registered a notable pullback.

According to DeFiLlama’s data, the TVL dropped from its yearly peak above $11 billion in January to just under $6.4 billion recently. This decline alluded to a contraction in DeFi capital allocation, something that may be driven by both macro volatility and reduced incentive programs.

Worth pointing out, however, that the press time TVL level was significantly higher than the pre-bull market base of 2023.

This can be interpreted to mean that Solana’s DeFi ecosystem retains meaningful traction across the board.

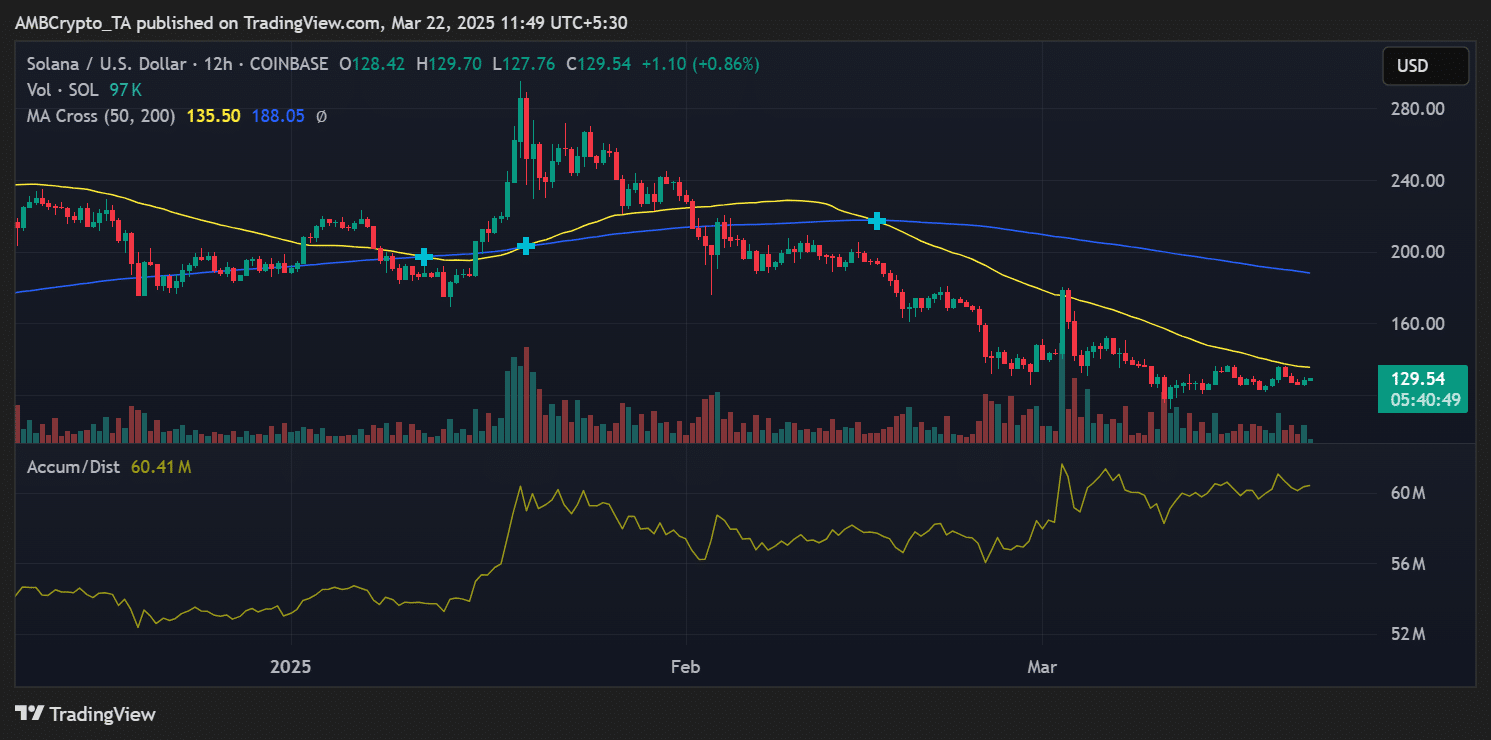

Solana’s price outlook – Rangebound, but supported by accumulation

At the time of writing, SOL was trading below both the 50-day [$135.50] and 200-day [$188.05] moving averages.

This hinted at a broader bearish structure. However, the Accumulation/Distribution Line highlighted consistent upward movement – A sign that smart money might be entering at press time levels.

With relatively low volume and resistance around $135, price action could remain rangebound in the short term. However, sustained on-chain growth could act as a tailwind for future rallies.

Solana has been exhibiting strong foundational demand, despite speculative capital pulling back. If the price eventually aligns with network strength, SOL may gear up for another rally on the charts.