- SUI surpasses TON in stablecoin transfers and daily active address usage on its platform.

- SUI approaches a key support level as traders place buy orders in the market.

Sui [SUI] has underperformed in the past month, dropping 35% with its price plummeting. However, selling pressure over the past week has subsided, as the asset lost a meager 3.42% to the market.

In the past 24 hours, momentum has deeply slowed down, indicating SUI could be heading for a recovery as metrics begin to show active participation from market traders. Here’s how:

SUI surpasses TON, a sign of growth

According to recent market data, SUI has surpassed TON in key market metrics, showing the involvement of market participants in the former as the likely preferred chain.

Currently, the stablecoin transfer volume on SUI has surpassed TON, reaching approximately $73 billion, while TON remains at $49 billion.

Such a significant difference implies that users prefer SUI and are likely to continue using the chain, which could impact a rally.

To confirm active participation, AMBCrypto compared the daily active addresses on SUI and TON.

At the time, there was a considerable difference in active addresses, with SUI reaching 1.8 million, while TON remained lower at 600,000—nearly a threefold gap.

Historically, active participation, particularly with such high-volume transfers, confirms that bulls are in the market, and SUI could benefit from its network’s usage.

Support level to provide rally catalyst

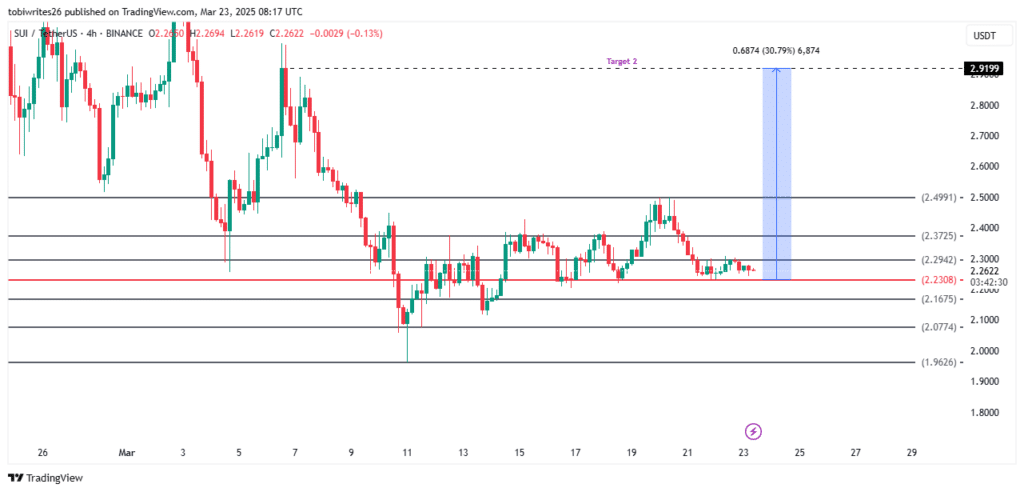

On the 4-hour chart, SUI shows potential for a major rebound as it approaches a key support level at $2.23, marked by the Fibonacci retracement line.

This level has been a point of interest for traders; the initial two times the asset traded into this level, it saw a major price rebound.

With the current market momentum, if SUI trades into this support zone again, it could see a major rally, with the first target at $2.50 and a continued move up if momentum sustains.

Market participants are placing bets

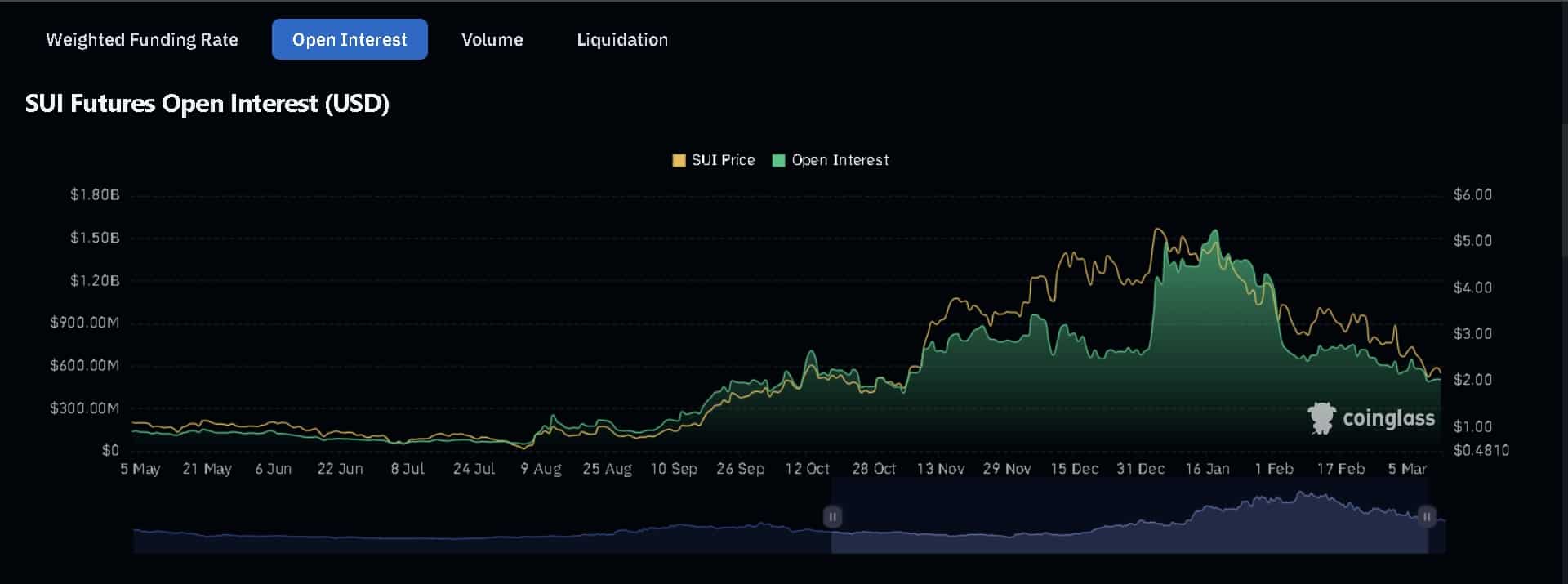

In the derivatives market, traders have begun placing bets. At the time of writing, the Funding Rate and Open Interest have turned low-positive, suggesting gradual buying.

The Funding Rate, which tracks which market cohort—buyers or sellers—is in control, shows that buyers have the edge, as it reads 0.0007.

Low-positive in this context suggests that buying activity has just begun but remains minimal.

Similarly, Open Interest has shown a similar movement. It has grown in the past 24 hours by 2.02%, reaching $618.07 million.

When there’s a gradual rise like this, along with a positive Funding Rate, it implies there are more long contracts than shorts in the market, and SUI could tilt in buyers’ favor, rising higher.